Every person entering into marriage always expects it to last. However, some people still sign a prenuptial agreement to protect their properties. A prenuptial agreement can help you maintain a clear financial path, no matter what happens. California has some of the oldest and most rigid divorce laws. A divorce, especially a contested divorce, can leave you in a compromising financial position. This is why a prenuptial agreement is necessary, even in the most agreeable marital situations. If you choose to enter into a prenuptial agreement, you should seek the services of an attorney to ensure your agreement is fair and valid. At the Los Angeles Divorce Lawyer, we have experienced attorneys who can guide you through drafting a prenuptial agreement and safeguarding your rights.

Understanding A Prenuptial Agreement

Also known as a prenuptial agreement, a prenuptial agreement is a written contract between two partners before marriage. A prenuptial agreement generally lists all the assets each individual owns and the debts they owe. It also spells out the rights of each person on the property during the marriage and in the event of a divorce. The agreement also permits partners to outline how their estate will be paid out to their spouse or if it will go to their family.

Individuals That Require A Prenuptial Agreement

Most people think that only the famous, the upper class, and the rich require a prenuptial agreement. However, a prenup can benefit anyone, even average-income partners. Couples enter into prenuptial agreements for several reasons, including:

Prenups Define And Protect Your Property

A prenup protects your assets and finances. A prenup as a legal document works in various ways. First, it defines the assets and finances that should remain solely yours. These are called separate properties. Separate properties could include the following:

- Investments you wish to keep for yourself.

- Money in a personal bank account.

- The property you purchased before marriage.

On the other hand, marital or community property belongs to you and your partner in equal shares.

You can also include a clause in a prenup that protects your future assets, like:

- Intellectual property.

- Income from a business you plan to start.

- Assets earned from a family trust.

A prenup ensures that your investments, property, and other assets are fairly divided. It also ensures that the division is done per your wishes instead of being subject to the unpredictable nature of divorce proceedings.

To Get Protection From Debts

You could use a prenup to protect yourself from your partner's debts, especially medical and school loans. In a marriage dissolution, a prenup also covers dividing your debts. You could find that you are stuck with a substantial portion of your partner's debt if you fail to clarify how to split these debts.

To Avoid Conflicts In Case Of Divorce

Nobody thinks about divorce when lovers are getting married, but most partners recognize it as a possibility. A prenup predetermines hot topics in a divorce, like who gets spousal support and the primary home. You can avoid possible arguments in a future divorce by outlining how you will divide your assets. You can also outline if any partners will receive alimony after divorce.

You decide ahead of time regarding possible disputes and disagreements between you and your partner. For example, you can agree to solve issues through arbitration or mediation instead of going to court. With a prenup, you can have a peaceful divorce and avoid an emotionally and financially expensive divorce.

Clarify Financial Rights

Partners with wealth or not, with children or not, can clarify their financial responsibilities during marriage. For example, you can state how to manage joint savings, household bills, credit cards, and bank accounts. You can also define your duties if you take your spouse through college or professional degree programs.

Pass Separate Assets To Children From Previous Marriages

Partners with children from previous marriages can use a prenuptial agreement to state what will happen to their assets and what these children will inherit from them when they die. You leave some property to the surviving partner and still pass on separate assets to your children. Without a prenuptial agreement, a surviving partner can have the right to claim a large share of the other partner's assets, leaving less for the children.

To Prenups Ensure Financial Stability For Both spouses.

Income disparity is always common among partners when heading into marriage. In most situations, one partner can enter into marriage with little income or take a break from their career to care for children. In this case, the partners can include several clauses in the prenup to define how the richer partner will provide financial support if divorce occurs.

Financial support can apply in several ways, including:

- Outline how spousal support will be handled in case of a divorce.

- A clause specifying a weekly allowance for the lower-earning spouse if he/she takes a break from work to take care of the children.

Essential Issues You Should Be Aware Of Before Signing A Prenup

There are several things you should consider or know before signing a prenup. They include:

Hire an Attorney

If you want to enter into a prenup with your spouse, you should first seek the services of an attorney. You could know the whole process, but an attorney understands the complexity of family law. Your attorney will ensure you have fair representation when signing the contract. The attorney will also clarify everything because he/she understands every section of the state's marriage law. In the case of divorce, your attorney will have laid everything out in a manner that can protect your property and rights.

Children Make Prenuptial Agreements Complex

Children can make the prenup contract complex, whether born after or before the prenup. You can make financial considerations for children from previous marriages because you cannot use your prenup to dictate child custody and support. If you fail to include provisions for these children, they could miss out on the assets if you die or divorce. It is essential to outline the specific inheritances for children from your former marriages.

A Judge Could Sometimes Declare Your Prenuptial Agreement Null and Void

Sometimes, the court can deem your prenup void, especially if you concealed some information when signing it. You and your spouse must agree on the prenuptial contract and disclose all liabilities and assets. The judge can deem the contract invalid if one partner does not willfully agree or fails to disclose assets or liabilities. The following are the reasons why the court can consider your prenup invalid:

- Failing to disclose your entire property.

- Inclusion of unreasonable provisions.

- Signing the agreement without reading and understanding it.

- Signing the agreement under duress.

Prenups Are Limited

Some partners view prenuptial agreements as rules the other partner must comply with to survive marriage, which is not the case. A prenup can only include rules concerning inheritances, debt allocation, assets, and spousal support. A prenup cannot constitute ultimatums or incentives that one partner can hang over the other partner. For example, you cannot have a provision in your prenup outlining that your spouse cannot drink or should stay home and raise the kids. Provisions like this can invalidate the whole prenup because they are not legally binding.

Discuss Your Prenuptial Agreement Early

Most couples hesitate to discuss a prenuptial agreement until their wedding date approaches. Some consider a prenup a simple thing they can draft at the last minute. However, you should draft a prenuptial agreement early. You should review it and discuss it with your partner and an attorney to know what works best. You should also take time to collect pay stubs, tax records, and declarations of liabilities and assets.

Signing a prenup at least 30 days before your wedding is best. You should draft it early to ensure you and your future spouse have sufficient time to discuss the changes. When you draft an effective contract, you can avoid worrying about it in the future. You should expect the process to take months if you involve an attorney. However, taking time instead of rushing to sign a prenup is best, only to regret it later.

You Can Amend A Prenuptial Agreement

Most people have the misconception that you cannot amend a prenup, which is not true. You can amend a prenup, even several times, but both parties must first agree. You could consider the changes if you and your partner secure new liabilities and assets and are unsure how to divide them. The advantage of a prenup is that you can add a sunset clause. The clause should state that it will be void if you fail to return and revise it by a particular date.

A Prenup Must Be Fair

Fairness is another thing you must consider when signing a prenuptial agreement. A prenup can only be just if it is fair and reasonable for both of you. The court can declare a prenup void if it does not meet the fairness aspect. The court can also deem a prenup unfair if the property division is disproportionate. Perhaps one partner possessed all the properties before marriage. When drafting a prenup, this partner outlines that he/she will take all the property in case of divorce. This could mean one partner would take everything after divorce while the other gets nothing. The court could declare this unreasonable and choose to consider other factors like:

- Burdens that could arise because of divorce.

- The lifestyle of the couple post-marriage.

You Must Disclose Liabilities And Assets In The Prenup Agreement

If your marriage fails to work, the purpose of a prenup is to keep the liabilities and assets separate. You must fully disclose the liabilities and assets for a prenup to work and accurately protect them. Some people love the idea of a prenup but are embarrassed or scared to discuss their debts and liabilities. Others fear that even with a prenup, they put their assets at risk if they disclose them.

If you disclose your liabilities and assets, the prenuptial agreement will be valid and enforceable in divorce. However, if you fail to disclose certain assets, the judge could declare the whole prenup void, and the court could split the assets. Disclosing your entire financial information is essential for a healthy relationship. It is also crucial for the contract's legitimacy.

The Prenuptial 7-Day Rule

Prenuptial agreements have legal requirements just like any other contract. For example, both partners must sign an agreement for it to be enforceable and valid. An agreement that neither partner signed is just a piece of paper. The uniqueness of prenups is that both partners in the agreement are emotionally tied up. Prenups are different from regular contract requirements, and they have their own set of requirements. For example, the 7-day rule Prenups require the 7-day rule, but standard contracts do not.

According to Penal Code 1615(c)(2)(B), prenups executed after January 1, 2020, have seven days between the time the partners receive the final prenup and the time it is signed. The partners are required to comply with this requirement, whether the attorney represents them or not. The 7-day rule gives both partners sufficient time to evaluate the conditions and seek legal counsel if they see fit.

Generally, the partners should wait at least three to six months before the wedding to start the prenup process. You will not have a valid prenup if you run out of time and do not have enough days left before the wedding to follow the 7-day rule.

Additionally, you will not get it if you are less than seven days from the wedding and need a prenup. This is because of the requirement of the 7-day rule; without it, you will not have a valid prenup. In this case, you could have only two options:

- Secure a post-nuptial agreement or

- Postpone your wedding and have the prenup drafted with all the essential requirements.

How To Keep Assets Separate Without A Prenup

Some individuals enter into a prenuptial agreement because each partner has assets or other property they want to protect. The property can include retirement benefits, physical property, or other accounts. It can be wise to have a prenup even if partners decide to share some of the assets that they accumulate during marriage or bring into marriage.

It could also be wise to create trust before marriage. This will clarify the separate properties and those that fall under the trust. Ensure you only pay for the house with the money earned from marriage if you own it and want to keep it separate. You can use this as evidence later to prove that your spouse does not jointly own the property.

If you have a personal bank account, keep it separate during marriage. Avoid depositing paychecks in personal accounts and using them to pay community expenses like mortgages and rent.

What Could Invalidate A Prenup?

Like any other legal document, violating the prenuptial agreement can invalidate the contract. A prenup can be invalid if it is not executed correctly after it is drawn and signed. For example, a prenup will be invalid in court if it is only a verbal agreement. The prenup will also be nullified if the partners fail to marry after signing the prenup.

It is possible to change a premarital agreement if the partners’ circumstances change after marriage. However, the partners must agree to changes and take the legal actions necessary to change the initial prenup. The partners could alternatively consider a post-nuptial agreement.

Limitations Of Prenups In California

There are several requirements that a prenuptial agreement must meet for it to be valid. Also, a prenup is limited and cannot include some provisions. The court will not enforce a prenup if it contains the following:

- Any conditions about the relationship.

- Non-financial requirements, including clauses like demanding that one partner change their appearance or lose weight.

- Unjust, unfair, deceptive, or exploitative conditions.

- Any language requiring illegal acts of a spouse.

- Any spousal maintenance requirements if the signing partner opted out of receiving independent legal counsel.

- Anything about child support or child custody.

All issues with child custody and child support are handled during the divorce. You can have an amicable divorce, whereby you agree with your partner on divorce. If you cannot agree on some divorce issues, the case proceeds to trial, and a judge makes the final ruling.

Find An Experienced Divorce Lawyer Near Me

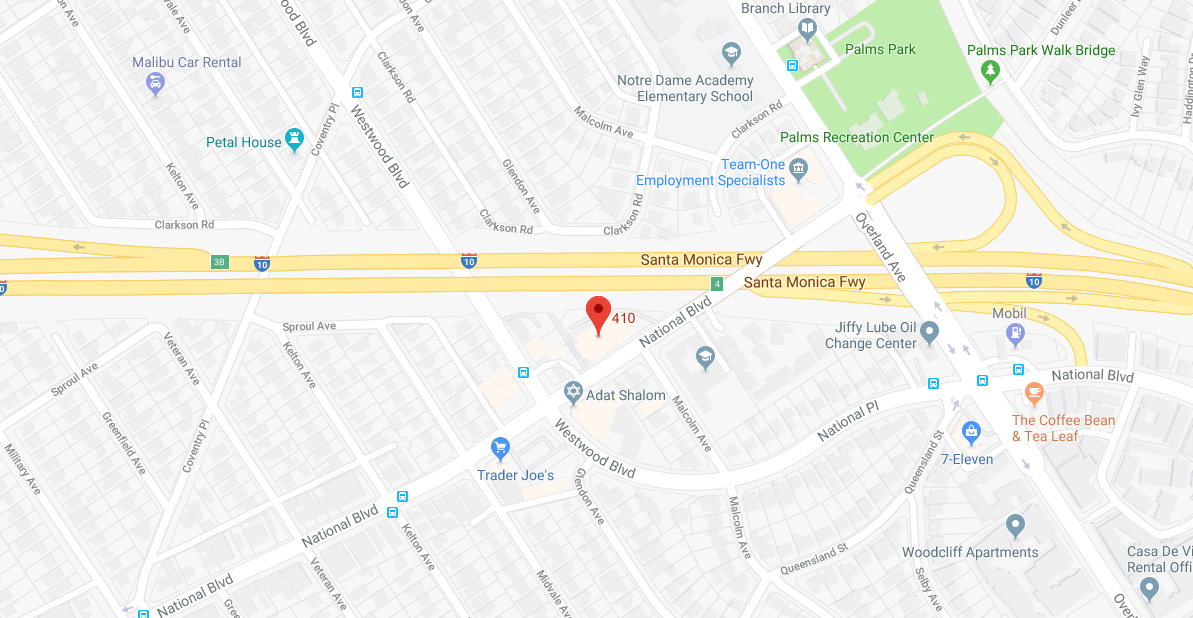

In California, a prenuptial agreement can include provisions regarding the couple's assets and debts and spousal support. It can outline management powers over separate or shared properties. It can outline the disposition of assets in the event of a divorce or the passing of a spouse. The parties can agree on their duties and obligations concerning assets or debts acquired before marriage acquired after marriage. If you need help drafting a prenuptial agreement or understanding the terms of a prenuptial agreement, contact the Los Angeles Divorce Lawyer. We have helped many clients draft prenuptial agreements that safeguard their rights without compromising their partners. Our experienced attorneys understand everything regarding prenuptial agreements. Contact us at 310-695-5212 to speak to one of our attorneys.